Tough new borrowing laws for Chinese market

For several years, the Australian property market has been an attractive investment option for Chinese investors. In 2014 to 2015 Chinese investment accounted for $24.3 billion of the Australian property market, doubling from the year prior.

Earlier this year, the major Australian banks including NAB, Westpac and Commonwealth bank clamped down on foreign borrowing, making it more difficult for Chinese and other foreign investors to take out home loans. In April, Westpac announced it would reduce its maximum loan amount to 70 per cent of the purchase price to investors earning incomes overseas, followed by NAB in May, which announced a reduction to 60 per cent, down from 80 per cent.

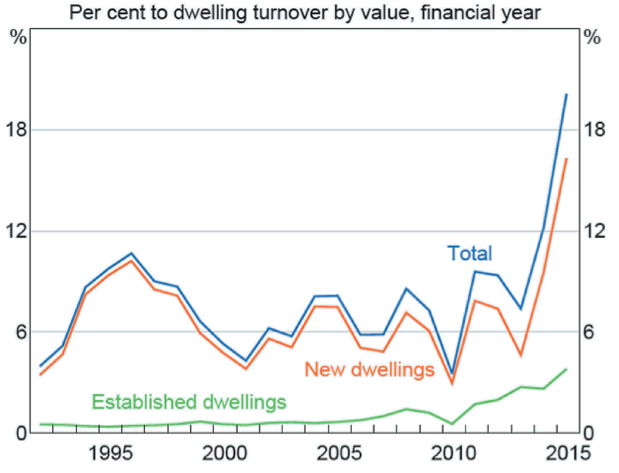

In addition to the tightening of borrowing rules, foreign investors in Australia are required to pay 10 per cent withholding tax on properties over $2 million, they must prove their residency and citizenship prior to application, and in Victoria are required to pay higher stamp duty rates and absentee owner land tax rates. Foreign investors are also restricted to purchasing new dwellings, a rule which has seen a rise in off-the-plan purchases from Chinese investors.

Foreign Investment Board Residential Real Estate Approvals

Source: http://www.rba.gov.au/publications/fsr/2016/apr/graphs/graph-b1.html

These tough new laws aim to reduce foreign income borrowing and are likely to soften the Australian market to help inject more local income into the housing market. While Australian banks aim to narrow borrowing rules to local income earners, the Chinese government is also becoming stricter when it comes to its citizens making foreign transactions.

With the major Australian banks clamping down on loans for foreign investors, overseas borrowing has shifted from the major banks to private lenders, who often have interest rates of up to 13 per cent. Despite the high interest rates of private lenders, the price seems to be worth it with many Chinese investors, although becoming wary of stiffening rules, remaining in the market.

What do the new laws mean for the Australian property market?

As borrowing and investing becomes increasingly difficult for overseas investors, it is likely that we will see a decline in Chinese investors in Australia. A fall in Chinese investors in Australia is likely to create a gap in the market which will see first time investors get a firmer foothold in the Australian housing market.

If you would like to discuss the current borrowing laws in Australia, talk to CPS Property today.