The truth about the value of your property over time

Amongst the perpetual property commentary within Australia, there is a lot of talk about the way property values double every seven to 10 years. But how true is this statement? It is true that the value of property in Australia does perform well compared to that of our fellow neighbours, but let’s have a look to see how much growth you can anticipate from your investment.

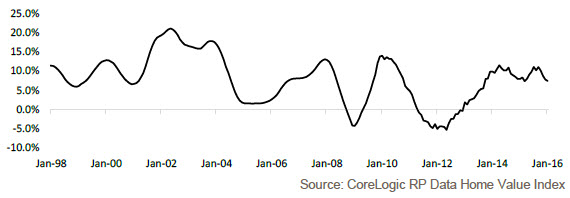

If we look at the period January 2006 to January 2016, we can see home values across our capital cities have increased by a total of 72 per cent – substantially less than the theory of ‘doubling every decade’.

Rolling annual change in combined capital city home values

Source: CoreLogic, 2016, http://www.corelogic.com.au/news/property-prices-double-every-decade

Interestingly, if we look at the decade prior, we can see that between January 1996 and January 2006, house values increased 159.6%. Based on these figures, we can see the most recent decade of capital city home value growth has been half of that of the previous decade. It is important to remember however, that these are blanket figures of all capital cities combined. As property investors, focusing on the performance of these cities individually is strongly advised before making a purchasing decision.

The Property Market Cycle

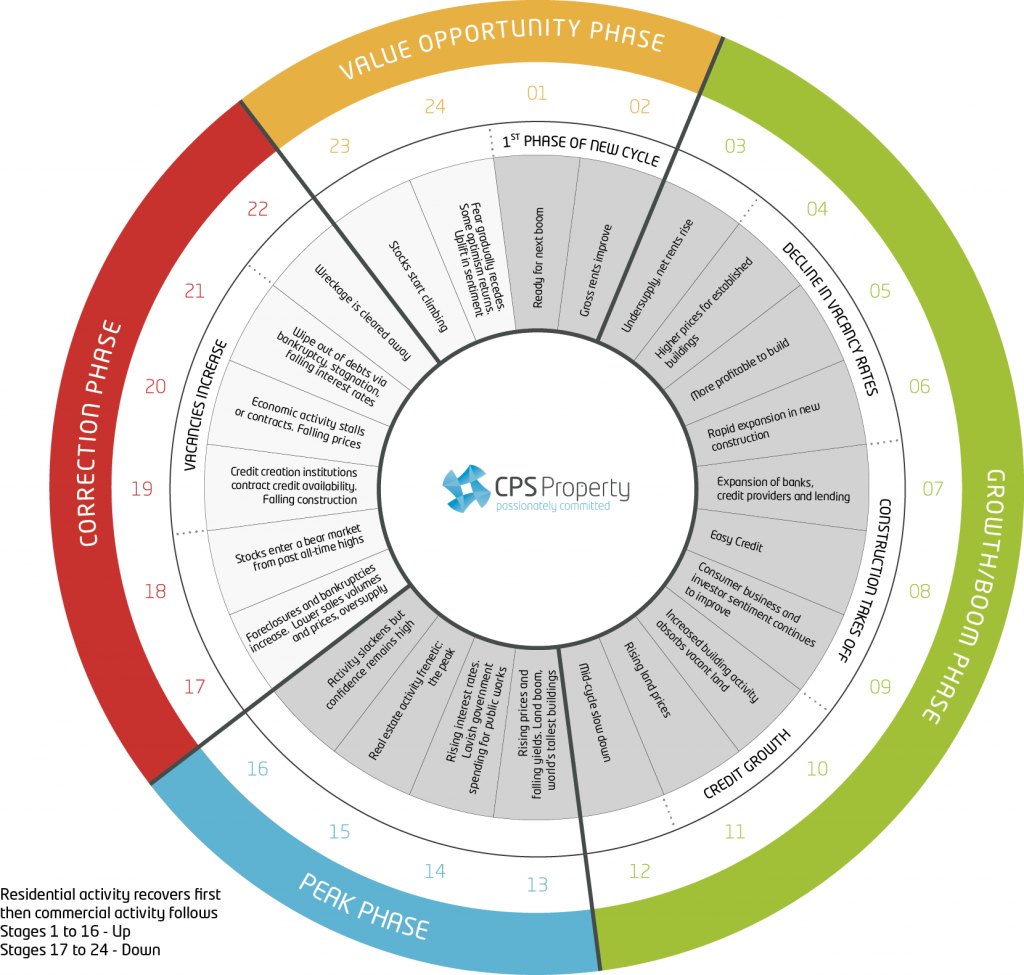

The property market’s performance is not linear, but rather a cyclical process which is depicted below via the CPS Property Wheel.

Essentially, at any one time, there are a series of sub-markets operating within the Australian property landscape – many of which are performing at different stages of the wheel. That means that properties in different areas are attracting different prices, at different times.

The answer to whether your investment value will double in a decade depends on several extenuating circumstances including where the market sits on the property wheel, the local economic performance including unemployment rates and plans for major infrastructure for the surrounding cities. For instance, Brisbane Airport is soon to become the second most important international hub and therefore is attracting high amounts of government support for new infrastructure and employment opportunities. This makes Brisbane a great prospect for property growth in the next decade.

Furthermore, it’s important to remember that historically price houses were off a smaller base. So although the value may have doubled in the period of 1996 to 2006, the values of homes were a lot less. Nowadays, it would be hard to keep up with “doubling per decade” as inflation cannot be sustained at that rate. The net value of the home is far greater than it used to be, which means a lot more money in the bank at the end of the day.

Tips for purchasing a property to maximise capital growth

Here are out top tips for purchasing a property to maximise your capital growth:

- Explore your options – look to other states and get a true gauge on their scope of growth within the next few decades.

- Look to the property wheel – once you’ve narrowed down a couple of options, analyse the performance in each region within the property cycle. Don’t forget that Australia is made up of several sub-markets and each state will be in different stages of the property cycle.

- Look back – when researching your preferred locations, ensure you analyse the history of sales and growth averages. Although you’re looking to the potential growth in the future, understanding the history of a location should provide solid learnings for future investments.

- Find the right price – ensure your investment has the room and flexibility to grow. Purchasing a property within the right price bracket is important to ensure you don’t under or over capitalise.

The property market is an ever changing and multi-dimensional landscape. To discuss the best investment options for you and your portfolio, contact CPS Property today.