The Brisbane shift: apartments tipped for growth

Australia’s property markets have been categorised by uncertainty for the last 18 months. The markets of Sydney and Melbourne continue to deteriorate, all while the fundamentals are now aligning for the Brisbane unit market; with early signs of improvement in a number of key fundamentals, and promising projections from Australia’s most respected economists.

What does this mean for price growth and rental return?

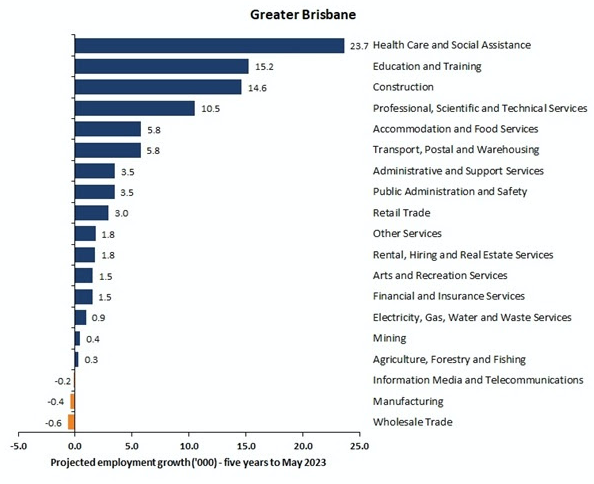

According to a recent Moody’s Analytics report, the QLD economy will continue to face challenges as it transitions away from its reliance on the resource sector. Whilst this transition will take time, there are strong signs of improvement. Over the 2017-18 period, the QLD economy grew by 2.6%. This represents a year- on year improvement of 0.5 %, For Brisbane, the economic outlook is positive as key infrastructure projects gather momentum. With many key projects focussed around the professional services, health, and education sectors; it is anticipated that employment growth in these fields will increase significantly over the next 5 years. This is illustrated in the graph below.

Source: ABS, Meridian Australia.

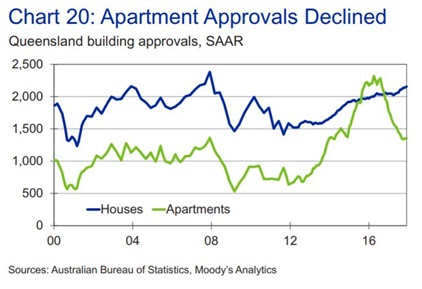

Since our article in June, the Brisbane market has seen strong improvements in several key fundamentals. With APRA interventions having largely played out, DA’s have dried up significantly, allowing for the oversupply of inner-city apartments to be absorbed.

Source: Queensland Treasury, Queensland State Accounts, June Quarter 2018, Meridian Australia

The decline in approvals has also impacted upon dwelling completions which have begun to ease.

Evidence of this is can be observed in the vacancy rate over the period; which has trended downwards from 3% in Jun 2017 to 2.3% as at June 2018.

With new apartment supply beginning to ease, it appears that the pendulum is beginning to swing in the supply/ demand balance; placing upward pressure on median rents for all apartment configurations. This is reflected in the table below.

Source: REIQ QMM September 2018

The above trends are echoed in the Moody’s report;

“A run up in supply over the past few years has capped gains in the apartment market…”

“…However, supply has tightened since its peak; the latest data suggest apartment building approvals have fallen from their 2013 levels.”

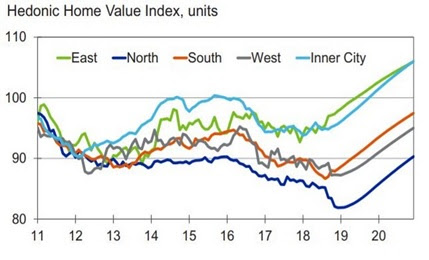

With strong improvements in several key fundamentals coupled with a stark affordability advantage over the Eastern Capitals, the Brisbane apartment market is tipped to grow by 2.8% in 2019. Over the same period, Brisbane’s North and Inner City are tipped to have the strongest performance; with forecast growth of 5.2% and 7.3% respectively.

This is illustrated in the table below:

REIQ- QMM September 2018, Meridian Australia

Source: Moody’s analytics, Core Logic

According to Moody’s Analytics, Greater Brisbane is forecast to experience medium to high growth in 2019 before slowing in 2020.

Source: Core Logic, Hedonic Home Value Index

Article source: Meridian Australia