Spotlight on Brisbane’s property market

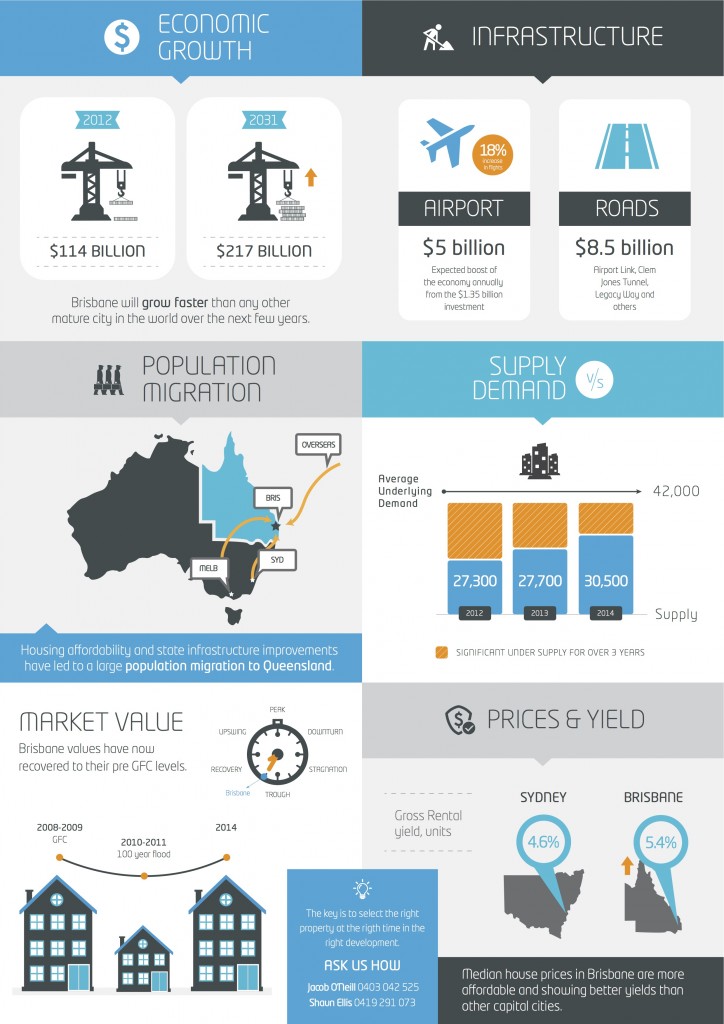

For the coming year, property investors are likely to shift their attention northward, from Sydney to more affordable Queensland. Brisbane is prospering and is set to grow more than any other mature city in the world. Forecasts suggest GDP will almost double to $217 billion by 2017.

There has been a significant undersupply of property in Brisbane for over three years. Coupled with increased migration to the area, demand is growing. Prices are more affordable in Brisbane than in Sydney and yields are also better at 5.4% compared to 4.6% in Sydney.

As with all investments, however, the devil is in the details. It is important to evaluate the single-family home, apartment and off-the-plan markets separately, with attention to the fundamentals of each local neighbourhood.

Three market segments

Houses

At the end of 2014, the median house price in Brisbane hovered around $474,000, a healthy $200,000 less than in Sydney. Many see the strongest potential in older suburbs situated within 10 kilometres of the city centre including Capalaba, Indooroopilly, Chermside and Enoggera, where prices have barely budged over the last three or four years.

Apartments

The median apartment price in Brisbane is in the neighborhood of $358,000, compared with Sydney’s $581,000.

Major apartment projects have begun to spring up in Coorparoo, Toowong, Chermside and Upper Mount Gravatt and even further out in the Logan and Ipswich regions. Larger three-bedroom apartments in suburbs further out may be particularly attractive to families.

Off the plan

Off the plan sales were undeniably strong in Brisbane in 2014, jumping 44 percent from 2013, according to some reports. To get the most exciting return, investors should be looking for properties in highly desirable and growing areas. Architectural distinction may also be the answer to the risk of oversupply, especially in the off-the-plan market.

Know your metrics

What’s hot and what’s not in the investment world can change very quickly, but property investors can insulate themselves from capricious changes in consumer taste by keeping an eye on fundamentals, neighbourhood by neighbourhood. Among the things to watch are:

- supply and demand numbers,

- infrastructure investment,

- population growth,

- unemployment statistics,

- affordability and

- historic trends.

It is the sum of these factors, rather than any one in isolation, that indicates a sound property investment.

The right investment choice will be dictated primarily by your personal circumstances and budget. Then you must ensure the location and the type of property meets your specific investment criteria and budget.

On these points, the Brisbane property market looks increasingly affordable in comparison to other states and we believe it is going to show the best capital growth and rental yield in Australia.