Five key tips to manage a rent reduction

Over the past three to six months, the Sydney rental market has seen a shift in behaviour that we haven’t seen in some time. This shift could have implications for investors and it’s becoming increasingly important to understand the details behind this movement. In short, the Sydney rental market has plateaued, and we expect this trend of low or reduced rental growth will be the next phase in the property cycle.

Why is the rental market softening?

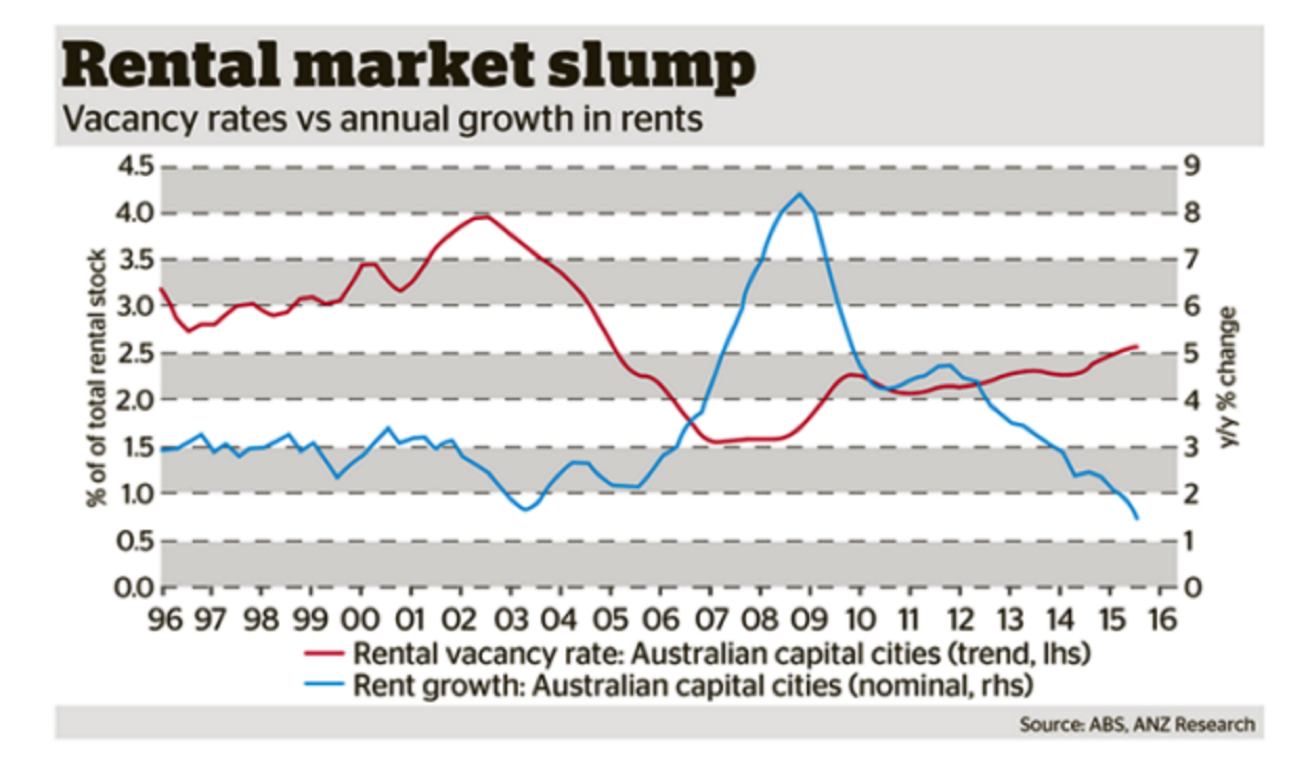

Investors have experienced unprecedented capital growth in their properties and have been paying historically low interest rates all while rents have been on the rise for a five year period. We’re now likely to see the power shift back to tenants for the next two to three years as a surge of new property hits the market.

Changes to the rental market may have repercussions for older stock, particularly as tenants seek out newer properties with modern facilities and amenities. This in turn can make it more difficult to lease older properties, particularly if there is little pricing differentiation.

There are four main factors that will force the rental market to soften, including:

- Lowest wages growth on record

- Relatively high levels of housing investment following record highs

- Historically high levels of new construction

- Slowing of population growth, creating less overall demand for housing.

The combination of these factors means that landlords have little scope to increase rents in the short term, and in most cases may recommend the same or less rent for the upcoming period. The prime objective during this time will be to minimise tenancy vacancy.

How to manage a rent reduction

While ebbs and flows are a natural part of the property market cycle, it’s important to be prepared and have a plan in place for a cooling market.

Here are five tips to help manage a rent reduction.

- Look long term. While cash flow is important and rental income is required to assist with debts, the main objective for investment property is to obtain strong capital growth. Generally speaking, a period of a softening rental market will not have a long term impact on the value of the property. It’s important to remember this if faced with a rental reduction situation.

- Be realistic. It would be an opportunity wasted to lose a tenant and risk having vacancy in your property for the sake of pricing your property too high. The market may continue to decline for a period of time, and it is best to be realistic from the beginning, rather than issuing a series of price amendments.

- Focus on the positives. When interest rates have dropped, it is likely you could be paying less on your loan – ultimately reducing the potential it could have on your overall cash flow.

- Get advice. Property managers are your resource to understanding how the current market factors could affect your property. Set aside some time to meet with your property manager to put a plan in place should a rent reduction be required.

- Don’t freak out. Although it may not be common or normal practice, rental reductions are part of the property cycle and shouldn’t cause panic among investors.

If you would like to discuss your investment options, contact CPS Property today.